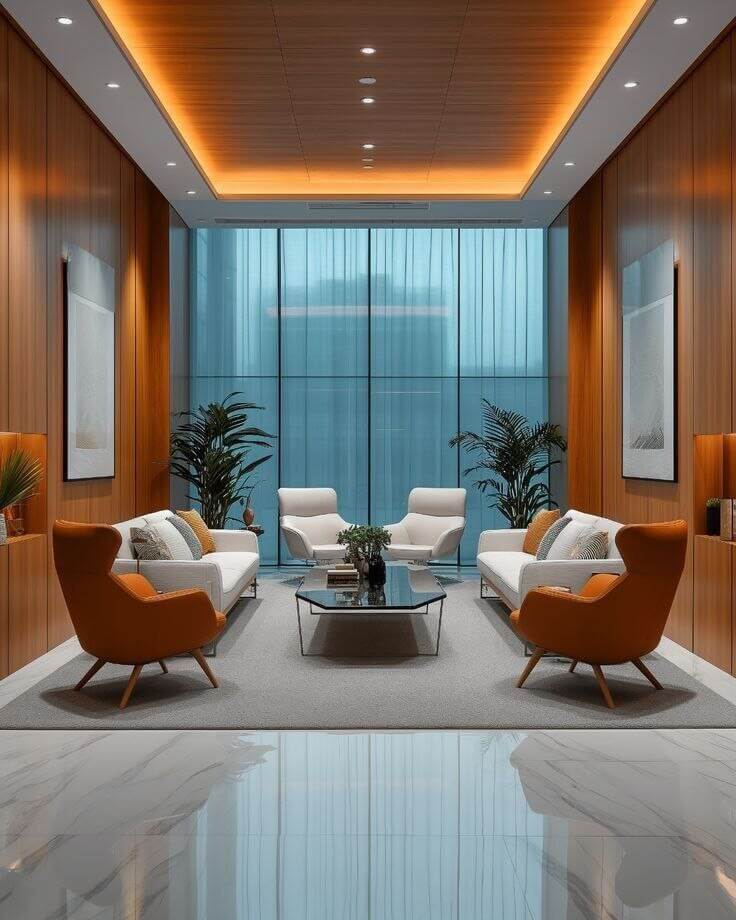

Flexible Third-Party Financing for Your Office Interior Needs

Creating the perfect office space can be an exciting journey, but the costs involved often become a barrier for many businesses. At Kova Interiors, we’re here to eliminate that obstacle by offering flexible third-party financing solutions.

Now, you can upgrade your office interiors or install premium glass partitions without the strain of upfront expenses. With accessible payment plans, tailored financing options, and quick approvals, transforming your workspace has never been easier

Ready to Redesign Your Workspace? Pay with Crypto Today!

Why Choose Third-Party Financing Services?

Third-party financing is more than just a payment option, it’s a gateway to unlocking the potential of your business space. Here are the top reasons to choose this convenient service:

1. Accessible payment plans

Spread the costs of your project over manageable monthly installments. Third-party financing allows you to access premium interior design and partition services without needing to pay the full amount upfront. This means you can invest in your office space without putting unnecessary strain on your budget.

2. Immediate transformation

Why wait to create the office of your dreams? With third-party financing, you can start your design or partition upgrade project immediately. No delays, no compromises—just a seamless path to achieving your goals.

3. Made for all businesses

We understand that every business is unique, and so are its financial needs. Our third-party financing solutions come with flexible terms, designed to adapt to the size and capabilities of your business. Whether you’re a startup or an established enterprise, our financing options work for you.

How Third-Party Financing Works at Kova

Financing your office interior project has never been simpler. Here’s a step-by-step guide to getting started:

Step 1: Select your desired service

Explore our extensive range of services and choose the one that fits your business needs. From workspace consultation to mezzanine floors, Kova Interiors offers a variety of solutions to transform your office.

Step 2: Apply for financing

Our financing process is straightforward and stress-free:

- Eligibility: Available for registered businesses only.

- Requirements: Basic financial documentation is required.

- Our team will guide you through the application process, ensuring you meet all the criteria with ease.

Step 3: Start your project

Once approved, you can kickstart your project immediately. Enjoy flexible repayment periods ranging from 2 to 12 months, ensuring your payments are both manageable and predictable. With financing in place, you can focus on creating a workspace that inspires and empowers.

Services Available for Financing

With our third-party financing, you gain access to the full spectrum of Kova Interiors’ premium services. Here’s what you can finance:

1. Workplace consultation

Reimagine your office workflow and create a space that promotes efficiency and innovation.

2. Office fit-out in london:

Transform your workspace with our bespoke fit-out services, designed to maximise functionality and aesthetics.

3. Mezzanine floors:

Add extra space and functionality to your office without relocating. Our mezzanine solutions are ideal for growing businesses.

4. Office space planning:

Optimise your layout for better productivity and employee satisfaction with our expert space planning.

5. Office refurbishment:

Give your workspace a modern facelift with our innovative refurbishment services

Key Benefits of Financing Through Kova’s Third-Party Provider

Choosing third-party financing with Kova Interiors offers a host of benefits:

1. Minimal upfront investment: Begin your project without a significant initial financial outlay.

2. Flexible repayment options: Customise your repayment plan to fit your budget and cash flow.

3. Immediate access to premium Sservices: No delays, start your project as soon as your financing is approved.

4.Simplified application process: Enjoy a hassle-free financing journey with quick evaluations and approvals.

Eligibility and Application Process

Financing through Kova’s third-party provider is designed to be inclusive and straightforward. Here’s what you need to qualify:

Who can apply: Registered businesses of all sizes.

Requirements: Stable financial records and basic documentation.

- Approval timeline: Quick credit evaluations to get your project moving fast.

- Our team is available to assist you at every step, ensuring a smooth application process.

Have questions about paying with cryptocurrency or choosing the right service? Speak with our experts now!

FAQ

What is the repayment period for financing?

The repayment period ranges from 2 to 12 months, providing flexibility based on your financial needs.

Which services can I finance?

You can finance any of our services, including office fit-outs, mezzanine floors, and workplace consultations.

How long does approval take?

Our third-party provider offers quick approvals, allowing you to begin your project without unnecessary delays.

Don’t let budget constraints hold you back. Contact us today to learn more about our third-party financing options and take the first step towards creating a workspace that inspires and empowers your team.